reit tax advantages canada

REIT is governed by and established pursuant to a declaration of trust. REIT Taxation in Canada Income Tax Treatment on Investment AccountsIncome tax on REITs is actually pretty simple to understand however the tracking of the details year after year is where the challenge is.

The 293 billion REIT is the lone real estate stock in the cure sector.

. How is the REITs market evolving in Canada. In the case of Canada a REIT does not pay business tax as long as its taxable income is distributed to unit holders. Homeownership in Canada is becoming increasingly unaffordable.

The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors. REITs are much lower risk with a proven history of outperforming direct real estate investing. This is in comparison to the roughly 10 return of the SP 500 and the 6 8 return of private real estate funds during the same period.

REITs are trusts that passively hold interests in real property. Income trust tax exemption just one advantage of investing in REITs Canada REITs can add to your portfolio in a number of other ways. This would result in higher interest going.

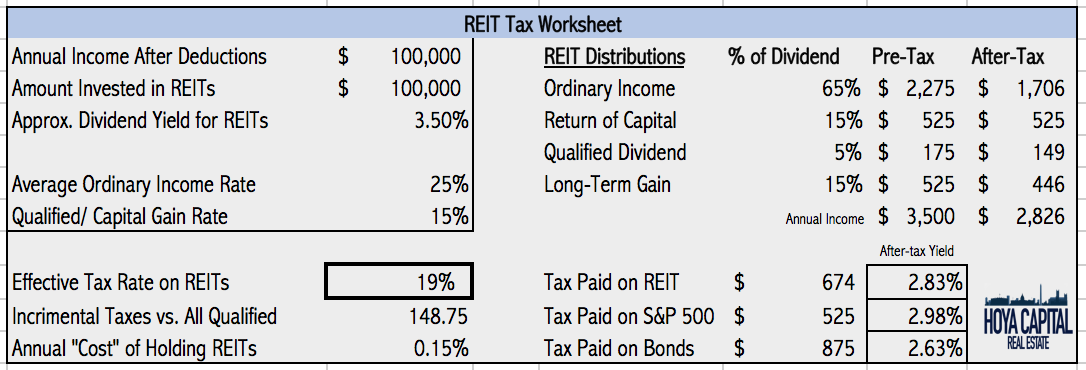

In Canada a REIT is not taxed on income and gains from its property rental business. 1 pre-tax income flows through to investors 2 investors get favourable tax treatment on the income and 3 a com-ponent of the tax obligation is deferred until the units are sold. On the subject of REIT taxation an article in the Financial Post states.

CrowdStreet makes direct investing in online real estate easy. In the RioCan example above you can see a pretty large. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

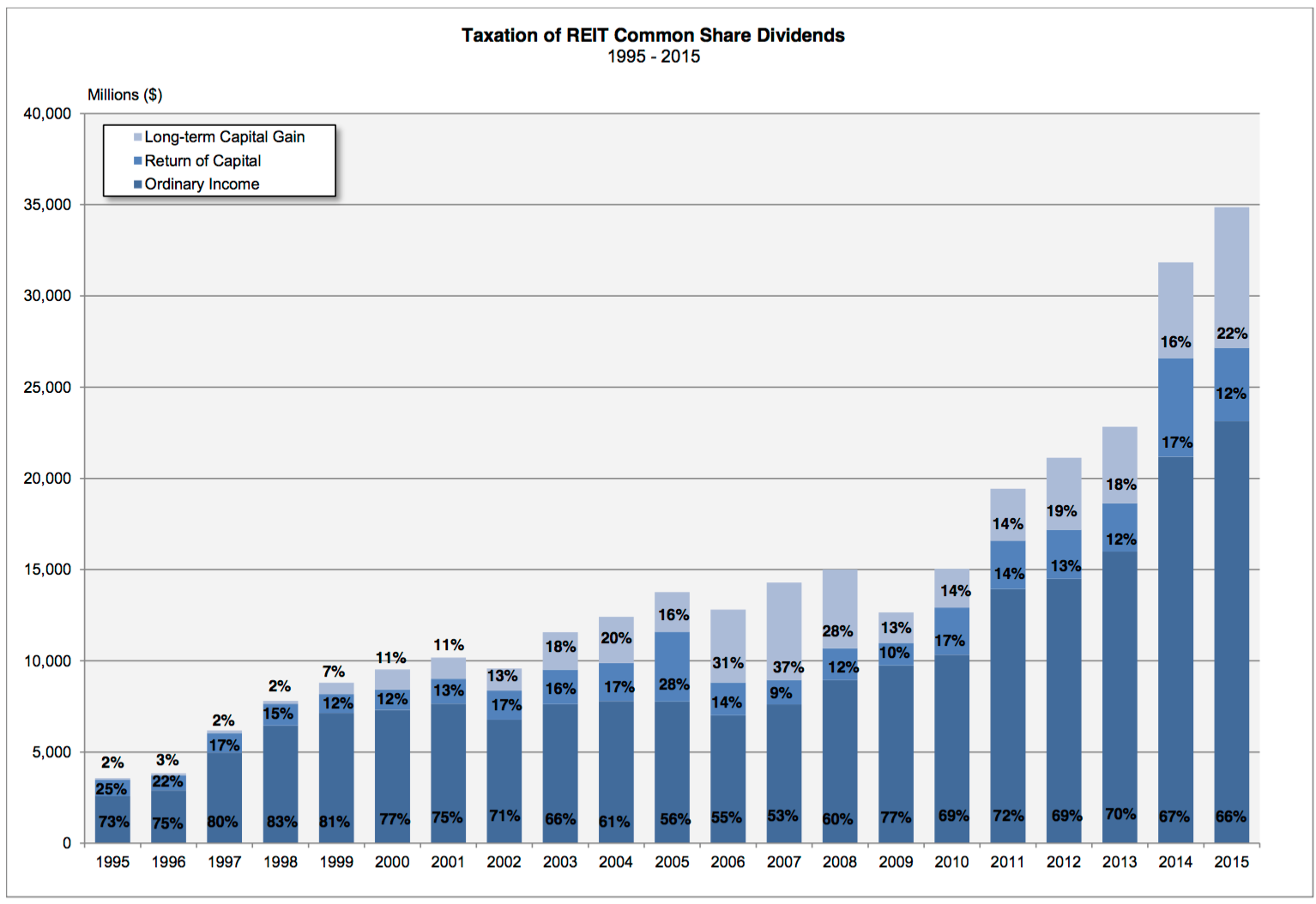

Capital gains taxes in Canada may inhibit REIT growth by preventing trusts from efficiently. Dividends from REIT companies are generally taxable as ordinary income above the maximum rate of 37 395. Starting in tax year 2018 an additional benefit has been added to REITs thanks to tax reform.

When calculated by taking into account the 20 deduction a Qualified REIT Dividend usually pays the highest tax rate of 290. Trustees of the REIT are generally subject to fiduciary duties similar to those applicable to. Buy real estate investment trusts REITs.

Theres a better way to invest in real estate. Investment income is taxed at 8. How Is Income From Reits Taxed.

REITs offer certain tax advantages to encourage this investment. The reduction in adjusted cost base ACB is what creates a tracking challenge. May rely on debt.

Fundrise just delivered its 21st consecutive positive quarter. Pros of REIT investment. It can take years to save for a down payment and even then the rise in real estate prices may move at a faster pace than savings.

And we continue to believe that low interest rates and government-stimulus spending may spur inflation over the next few years. Sign-up for free today. Dividends fromREITs are commonly taxed as ordinary income under a maximum of 37 returning to 3965With 3 additional increases in 2026 the rate will be 6Investments are subject to an 8 surtaxIn addition most individuals can generally deduct 20 of the combined Qualified Business Income earned up to.

Investors seeking tax benefits REITs offer three major tax benefits. The unique tax advantages offered by real estate investment trusts REITs can translate into superior yields. In principle REITs like the business income and royalty trusts of yesteryear improve capital market efficiency in this sense.

REIT Tax Benefits No. In anticipation of the new tax many income trusts converted to corporations over the past few years. Trustees of the REIT hold legal title to and manage the trust property on behalf of the unitholders of the REIT.

Since their introduction to Canada REITs have become an attractive onshore tax-efficient vehicle for investors. In 2026 the budget will rise to 6 with an additional 3. The clear advantage of a REIT is to reduce corporate and personal taxes on income paid to investors 1 A report from Grant Thornton LLP agrees.

Buying REIT units is. Get your free copy of The Definitive Guide to Retirement Income. Learn more about how REITs are taxed.

The 542 of my dividends that are qualified. Instead shareholders are taxed on a REITs property income when it is distributed and some investors may be exempt from tax. On the other hand investors can purchase a single unit of a REIT for as little as 10.

The 293 billion REIT is the lone real estate stock in the cure sector. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals and. From 1977 to 2010 REITs have returned more than 12 annually.

A higher dividend payout by many REITs like Ventas VTR may force management to go for higher leverage to expand real estate holdings. Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace. The effect of the new tax is to treat these entities like corporations and eliminate their tax advantage.

Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Growth investors While the first two priorities are stability and income distribution. Depreciation and Return of Capital.

It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals and. Real estate trusts are a different animal from typical corporations. In many countries REITs enjoy certain tax advantages for instance in Canada they arent taxed on gains from property and rental incomes as long as they meet certain criteria in relation to distributions and hold only qualified properties.

They can provide a hedge against inflation for example. There is however an important exception to the new rulesReal Estate Investment Trusts REITs but only if they meet certain conditions. Sit back and collect rent.

The REIT collects rental income pays its expenses and then distributes almost all its remaining incomeusually 85 to 95to unit. Here are the benefits.

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Introduction To Canadian Reits Seeking Alpha

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reits Vs Real Estate Mutual Funds What S The Difference

Residential Reits In Canada Lag As Trudeau Weighs Investor Curbs Bnn Bloomberg

Introduction To Canadian Reits Seeking Alpha

The Taxman Cometh A Look At The Tax Efficiency Of Reits Nysearca Vnq Seeking Alpha

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

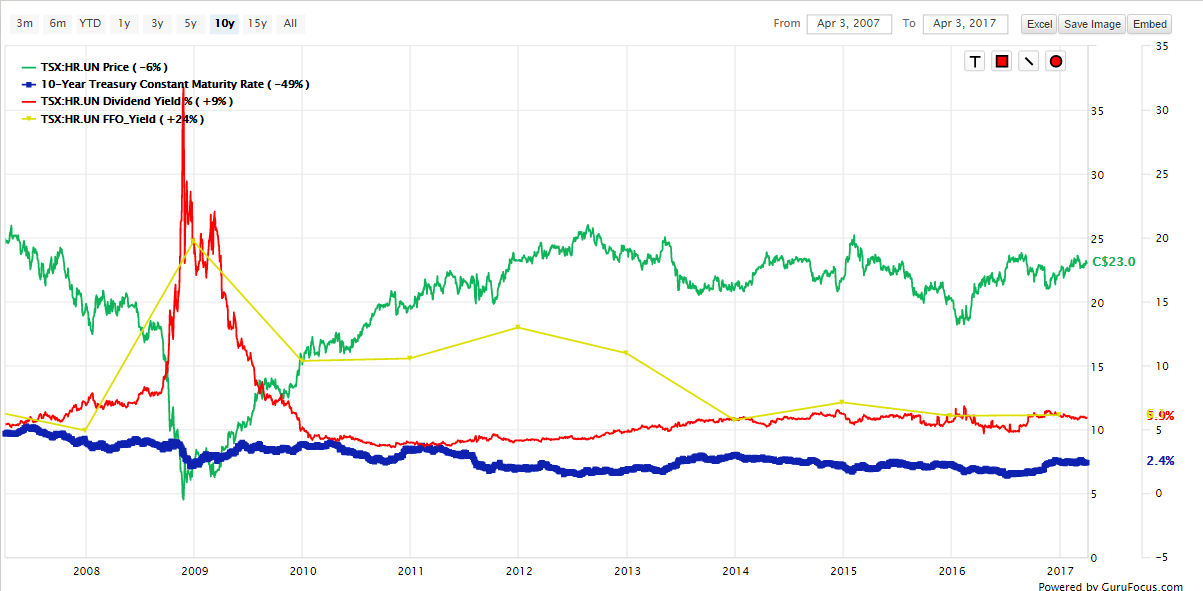

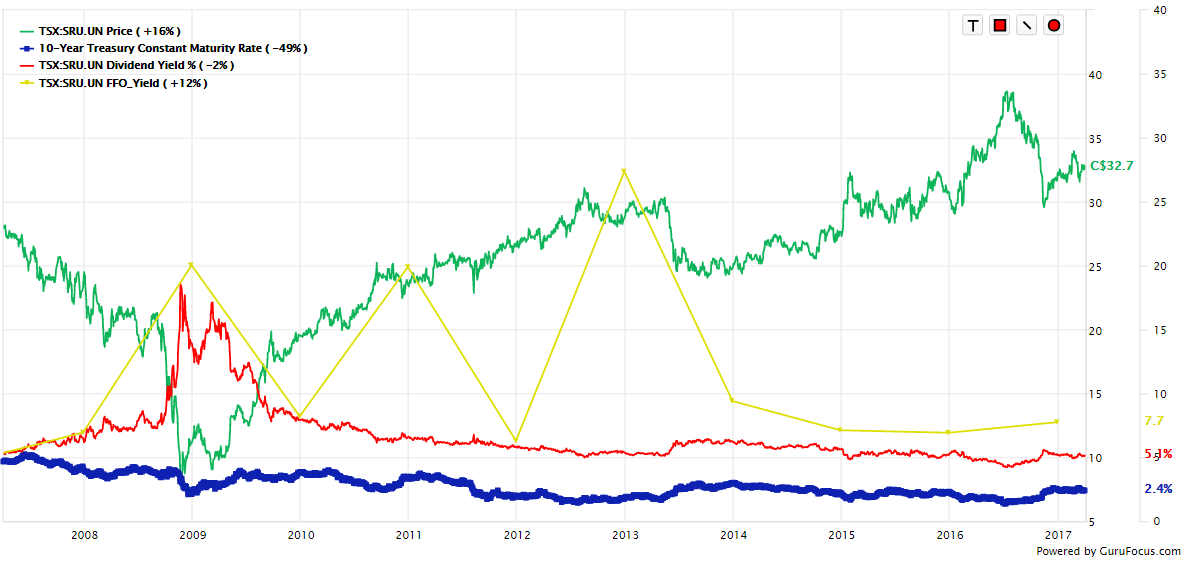

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Reits Real Estate Investment Trusts And Tax Withholding Tax Worldwide

The Liberals Plan To Review Tax Treatment Of Reits Will This Help Renters Investment Executive

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube

2 Canadian Reits To Buy That Just Increased Their Distributions

Canadian Reits Vs U S Reits Which Are Better Buys For Canadians The Motley Fool Canada

Reits Explained For Canadians Real Estate Investing For Beginners Passive Income Investing Youtube